Term Insurance Quote

What is Term Insurance?

A term insurance policy is a type of life insurance that provides coverage for a specific period of time, also known as the “term. If the policyholder dies during the term, the policy will pay a death benefit to the beneficiary. If the policyholder does not die during the term, the policy will expire and will not pay a benefit. Compare & Buy Life insurance from Coverbox.

For example, a healthy, non-smoker 24-year-old male can get INR 1 crore cover for his dependents for the next 25 years. If he buys a term insurance plan, he can get term insurance of 1 Crore for less than INR 600. This shows that it is the most economical option as compared to other life insurance plans. Lets Compare & Buy Life insurance from Coverbox.

Types of Term Insurance

There are various term life insurance companies offer different term plans in India. Each term plan has its own set of features. Let’s discuss these different types of term insurance plans in detail:

Level Term Plan

It is the easiest and most basic term life insurance plan. Level Term Plan provides a fixed sum amount to the beneficiary in case of the policyholder’s demise. In the level term plan, Both the premium and death benefit are fixed throughout the policy tenure. Compare & Buy Life insurance from Coverbox.

Term Return of Premium Plan (TROP)

Term return of premium plan is a type of term insurance plan in which the life insurance company returns the premium paid for the cover in case the insured survives the policy tenure. These policies are gaining popularity as the policyholder will get back the money he has invested for the term insurance cover. Compare & Buy Life insurance from Coverbox.

Increasing Term Insurance Plan

In increasing term insurance, the policyholder can increase the sum assured amount annually during the policy tenure. The increasing term insurance plan provides coverage for the risk of rising inflation costs in the country. Compare & Buy Life insurance from Coverbox.

Decreasing Term Insurance Plan

Decreasing term plan is a type of term insurance plan in which the Sum Assured reduces every year at a pre-specified percentage. This type of plan is usually issued by the bank to recover the loan and pay all the debt. Compare & Buy Life insurance from Coverbox.

Convertible Term Plan

Convertible term insurance plan is a type of term insurance plan which can be converted to another type of term plan at later stages of the policy. For example: If you buy a term life insurance plan for 25 years, then after 5 years you can convert it to any other type of term insurance plan like an endowment term plan, level term plan, etc. Compare & Buy Life insurance from Coverbox.

Some of the top term insurance riders available under term insurance plans are listed below:

- Accidental death benefit rider: This rider covers death resulting from an accident. In the event of an untimely demise of the insured in an accident, the rider sum assured is paid along with the sum assured of the base policy, providing the beneficiary an enhanced death benefit due to the rider.

- Accidental death and disability benefit rider: This rider is similar to the accidental death rider with added coverage for disability due to an accident as well. In case the insured dies or suffers permanent total or partial disability resulting from an accident, an additional benefit is paid out to the insured or their beneficiary, as the case may be. In case of accidental death and disability, 100% of the rider sum assured is paid. However, in the case of permanent partial disability, only a percentage of the sum assured is paid, depending on the severity of the disability suffered. Moreover, in the case of disability, the benefit might be paid in weekly or monthly installments and future premiums may also be waived off.

- Critical illness rider: This is a very popular rider covering specific critical illnesses. If the insured is diagnosed with any of the critical illnesses covered by the rider, the sum insured by the rider is paid in a lump sum.

- Term rider: This rider entitles the beneficiary of the insured to an additional benefit in the event of the unfortunate death of the insured during the term of the policy. The death can be the result of an accident or due to natural causes.

- Premium waiver rider: This rider is applicable in case the person insured is different from the policyholder paying the premium. Under this rider benefit, if the premium-paying policyholder dies during the term of the policy, the remaining premium payable is waived off. The insurance company pays the premium on behalf of the policyholder and the policy continues undisturbed.

- Terminal illness rider: This works similarly to the critical illness rider however does not cover only specified critical illnesses. Any type of terminal or long-term illness is covered by the insured. The sum assured is offered by the rider to help the insured cover the excessive cost involved in the treatment of the terminal illness. This also helps ease the financial burden of getting the long-term treatment done.

Eligibility for Buying Term Insurance Plans

This type of life insurance plan is suitable for individuals who want to secure the financial future of their family members in case of any unfortunate events. To avail of this coverage, individuals need to meet certain eligibility criteria set by insurance providers. These criteria ensure that the insurance contract is viable and that the risk is adequately assessed. Compare & Buy Life insurance from Coverbox. The term insurance eligibility criteria in India typically revolve around factors such as age, income, health, and lifestyle choices.

- Age Criteria : Age plays a significant role in determining term insurance eligibility. Most insurance companies have a minimum and maximum age requirement for policyholders. Generally, individuals in the age range of 18 to 65 years are eligible to apply for term insurance. The specific age limits can vary among insurers and might be subject to change based on the prevailing market conditions and the company’s underwriting policies.

- Citizenship : The citizenship of the customer affects the eligibility for term insurance, as many Indian insurers do not offer plans to individuals from a different country. Therefore, it is suggested that, you always check your term insurance eligibility before buying term insurance from India.

- Income Criteria : Insurers often consider an individual’s income as an indicator of their financial responsibility and ability to pay premiums. While there isn’t a fixed income threshold, policyholders are typically required to have a stable source of income to ensure they can meet premium obligations. The sum assured, which is the amount paid to beneficiaries in case of the policyholder’s demise, is often linked to the policyholder’s income, and therefore, becomes a key determining factor for term insurance eligibility.

- Health Status : Health plays a crucial role in term insurance eligibility. Applicants are usually required to disclose their medical history, existing health conditions, and lifestyle habits (such as smoking or alcohol consumption). Some insurers might require a medical examination or request medical records to assess the applicant’s health accurately. While pre-existing health conditions might not necessarily disqualify an individual, they could influence premium rates.

- Lifestyle Habits : Lifestyle choices can impact term insurance eligibility and premium rates. Risky behaviors such as smoking or engaging in hazardous activities might lead to higher premiums or even a denial of coverage. Insurance companies assess these factors to determine the level of risk they are taking on by providing coverage.

- Occupation Type : Some insurers do not offer term plans to individuals within certain occupations, like people who are in the army, work at mines or other such high risk jobs. Thus, it is essential to check your eligibility for term insurance before buying the most suitable plan.

- Policy Term and Sum Insured : The chosen policy term and sum assured also play a role in eligibility. Insurers might have specific limits on the minimum and maximum sum assured based on the applicant’s age, income, and other factors. Additionally, the policy term chosen should fall within the age limits specified by the insurer.

- Medical Examination : In some cases, insurance companies might require applicants to undergo a medical examination, especially for higher coverage amounts. The examination helps insurers assess the applicant’s health condition accurately and determine the associated risk. This becomes a factor for eligibility of term insurance while buying the plan.

In some cases, insurance companies might require applicants to undergo a medical examination, especially for higher coverage amounts. The examination helps insurers assess the applicant’s health condition accurately and determine the associated risk. This becomes a factor for eligibility of term insurance while buying the plan. Lets buy Compare & Buy Life insurance from Coverbox.

Documents Required for Buying Term Insurance Plans

Compare & Buy Life insurance from Coverbox. Most insurance companies require prospective policyholders to submit a set of documents while buying term insurance plans. The following documents are generally required for submission:

- A proposal form, duly filled and signed

- Age proof (Driving License, PAN Card)

- Identity proof (Aadhaar Card, Voter ID)

- Address proof (Passport, Utility Bills)

- Proof of income (ITR for the previous 3 years, salary slip)

- Recent passport-sized color photographs of the insured and the policyholder (if both are different)

- Form 16/PAN (mandatory)

- Proof of latest medical records

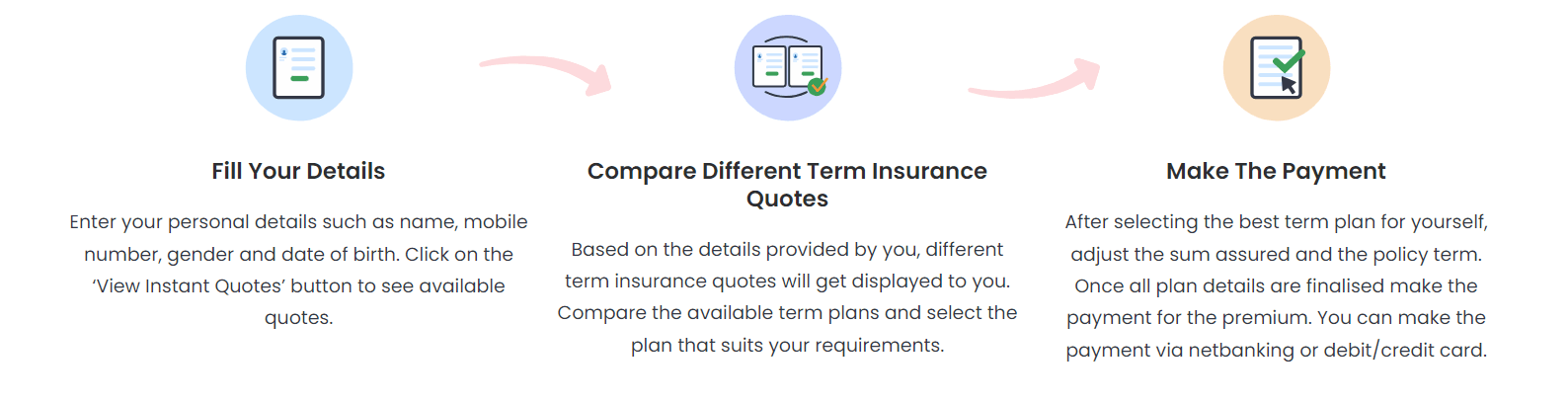

How To Buy Term Insurance With Coverbox?

Did Not Find What You Were Looking For?